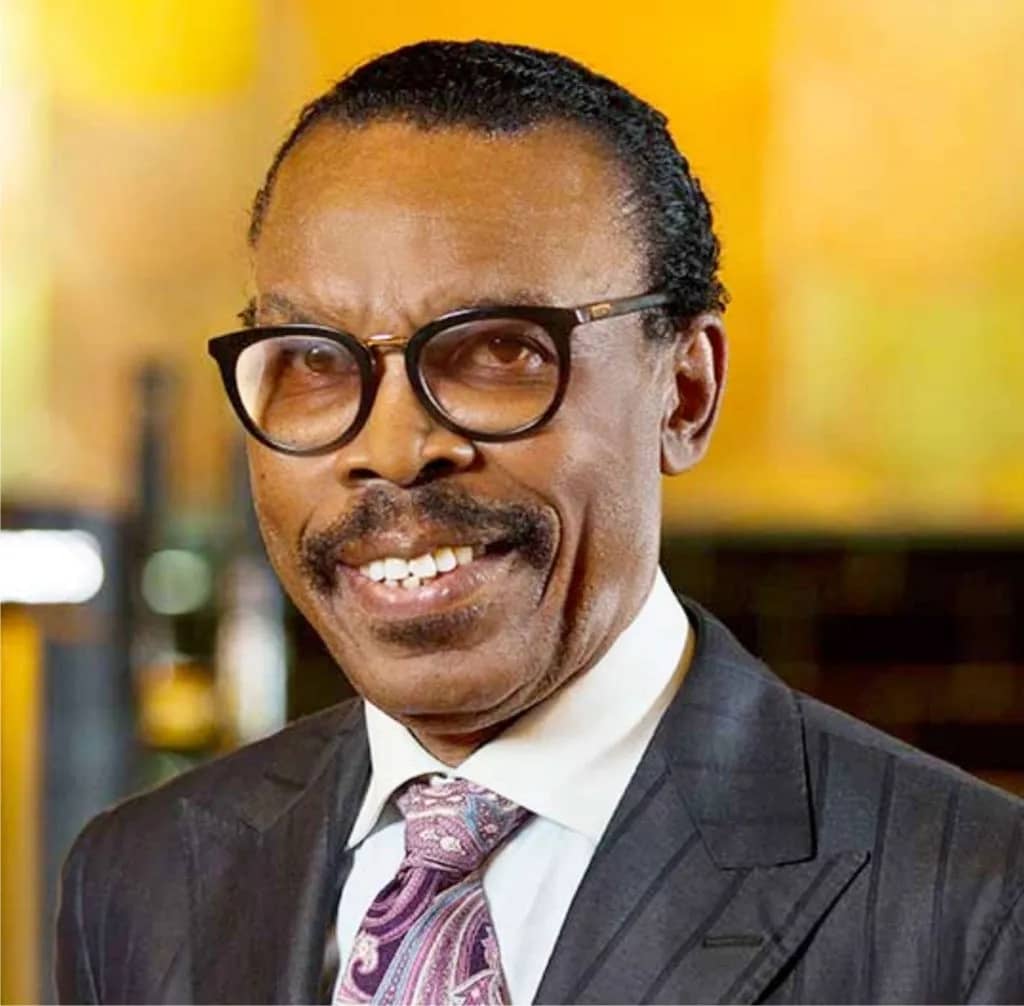

Nigerian Aviation Sector Needs Efficiency to Access Credit Facilities, Says Economist Bismarck Rewane

Bismarck Rewane, the Managing Director of Financial Derivatives Company Ltd has said the aviation industry has to be more efficient to be an attractive market to banks and financial institutions.

While delivering his keynote speech at the 29th Annual LAAC Conference, themed Financing Aviation in Nigeria :Risks , Opportunities and Prospects “, he added that if the industry is efficient, better governance, transparency, accountability, and all other things will fall in place.

He recommended that key players in the industry are united in order for the financial system to be viable.

“Nigeria has 23 active domestic airlines. The industry is ripe for consolidation but it’s fragmented. When you have a fragmented industry, people are consolidated, and they will shake out inevitably.

Nigeria has poor management system and poor leadership.

“The industry itself has to be efficient in the first place to be attractive. Banks don’t throw away money, banks lend money to get it back. Delta Airlines, American Airlines, Lufthansa, Singapore Airlines are all doing well because they’ve become very efficient and innovative.”

The Chairman of LAAC , Mr. Suleiman Idris , while giving his remarks said to unlock the potentials in the aviation industry ,innovative financing mechanisms, ranging from public-private partnerships, building, operating, and transferring models, leasing arrangements, to sovereign-backed financing and targeted foreign direct investment must be embraced.

He said these tools cannot thrive without a manoeuvrable environment, one that assures policy consistency, regulatory transparency, and ease of business.

According to him, the aviation sector is capital-intensive by nature, requiring substantial investments in airport infrastructure, aircraft acquisition, maintenance, safety systems, and personnel development.

He noted that Nigeria, like many developing nations, faces challenges such as limited access to long-term financing, high interest rates, foreign collectivity, policy inconsistency, and a lack of universal confidence, all of which appear to be real and pressing risks.

Idris called for collaboration among the government, private sector players, financial institutions, and the media.

“Nigeria’s large population, our strategic geographical location, a growing middle class, and an increasing appetite for domestic and international air travel present a compelling case for targeted aviation investments.

“The Nigerian aviation industry must also commit to building investors’ confidence through sound governance, accountability, and a clear vision for the future.”, he said.

One Comment