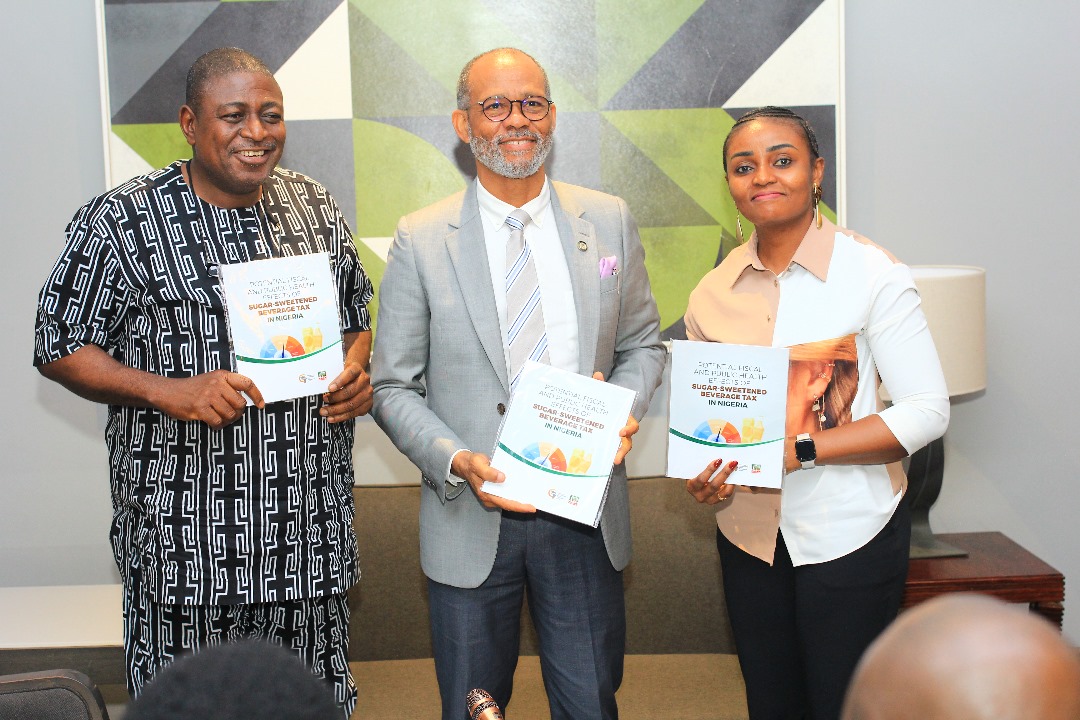

CAPPA’s Executive Director Akinbode Oluwafemi, Lagos State Commissioner for Health Prof. Akin Abayomi and Nigeria Coordinator of Global Health Advocacy Incubator Joy Amafah displaying a copy of the simulation study of the “Potential Fiscal and Public Health Effects of SSB tax in Nigeria” during Tuesday’s meeting.

The Lagos State Government is considering a pro-health levy on Sugar-Sweetened Beverages (SSB) to boost public health and lower the rising non-communicable diseases (NCDs) burden.

Commissioner for Health Prof. Akin Abayomi noted that an SSB levy would contribute to driving the state’s human capital agenda – healthier children and good nutrition – and positively impact its health and education sectors.

This was contained in a press release by Robert Egbe, Media & Communications Officer, CAPPA.

The global public health expert, disclosed on Tuesday during a meeting with transparency watchdog Corporate Accountability and Public Participation Africa (CAPPA), United States-based Global Health Advocacy Incubator and the Centre for the Study of Economies of Africa (CSEA).

Prof. Abayomi’s comments followed the delegation’s presentation of a simulation study of the “Potential Fiscal and Public Health Effects of SSB tax in Nigeria”.

“Nigeria is the 4th highest soft drinks consuming country in the world, and the study proposes, among others, that to wean Nigerians off their addiction to SSBs and bring down the NCDs burden, the federal government ought to increase the SSB Tax to N130 per litre, from the current N10. Nigeria

“Nigeria is the 4th highest soft drinks consuming country in the world, and the study proposes, among others, that to wean Nigerians off their addiction to SSBs and bring down the NCDs burden, the federal government ought to increase the SSB Tax to N130 per litre, from the current N10. Nigeria

The policy could also earn the government an estimated N729 billion in tax revenue, which CAPPA and other stakeholders propose could be allocated to strengthening the health sector.

CAPPA’s Executive Director Akinbode Oluwafemi explained the health and fiscal benefits of the policy for Lagosians.

CAPPA’s Executive Director Akinbode Oluwafemi explained the health and fiscal benefits of the policy for Lagosians.

He said: “We think that this is one of the tools that we can use to lower NCDs that are becoming a big burden in Nigeria – including obesity, high blood pressure, etc.

“The government imposed a N10 per litre tax on SSBs in 2021, which is actually five kobo for 50cl of SSBs. At that time, it (SSBs) was selling for N100. It is a fixed tax. Today, it is selling for N300. The government tax is still N10. And if you look at the inflation rate, that, in itself, needs to have been improved.”

“We commissioned the Centre for the Study of Economies of Africa (CSEA) to look at the potential health and fiscal impacts of SSB tax. We did a simulation, and even before the floating of the naira when this study was completed, the simulation projected that N130 should be the appropriate tax per litre of SSBs in Nigeria.”

Oluwafemi expressed delight at engaging policymakers like the health commissioner, adding, “We see Lagos as one of the champions of public health policies, and how we can take this further.

“We are looking for support because we will soon be looking at a national legislation that will make Sin Tax a much more sustainable law rather than every year and at that point we will be looking at champions to speak for this.”

Responding, the commissioner acknowledged the problems caused by NCDs and advised that localised legislation through the House of Assembly would align with the state’s immediate health goals.

Prof Abayomi reasoned that funds raised through such a policy could be “channelled specifically to the areas of the consequence of those consumptions. So, it can go to health and education, because we’re now using it to drive a human capital agenda, which is healthier children and good nutrition.

“Health access and going to good schools: these produce our human capital infrastructure. In Lagos, we have two kinds of infrastructure: a physical one and human infrastructure. That’s how we look at it.”

Earlier, Joy Amafah, Nigeria Coordinator of Global Health Advocacy Incubator, highlighted the importance of the Lagos health ministry and the commissioner’s office to the goal of a healthy Nigeria.

Amafah added: “We see your office as a critical policy health champion to help us achieve this and also to create a legal pathway beyond the Finance Act that is more sustainable, that will create a sustainable implementation framework for SSB taxes such that there could be an opportunity for earmarking of revenue generated from tax collected to other public health interventions, an opportunity for a sustainable implementation such that it is not every year that advocates and the government will have to justify why the tax should be there.

“Even before the inflation, N10 per litre was far from global recommendations. So, we’re advocating for your support, leadership and guidance in pushing this forward.”

According to the 2022 World Health Organisation (WHO) Manual on SSB Taxation Policies to Promote Healthy Diets, SSB taxes can be a win-win-win strategy: a win for public health (and averted health-care costs), a win for government revenue, and a win for health equity.