Stakeholders Urge FG to Attract, Retain Manufacturers, Boost Nigeria’s Business Environment

..FirstBank Assures Customers of Support for Agriculture, Non-oil Exports, Fintech, SMEs, Others

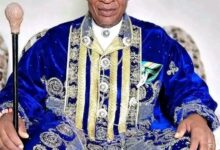

Executive Director, Retail Banking South, FirstBank, Oluseyi Oyefeso (left); Head, Strategy & Corporate Development, Chike Uzoma; Group Executive, Transaction Banking, Olaitan Martins; Executive Director, Corporate Banking, Tosin Adewuyi; Special Assistant to the President on PEBEC and Investment, Jumoke Oduwole; Founder and Chief Consultant, B. Adedipe Associates Limited (BAA Consult), Dr. ‘Biodun Adedipe; Group Head, Marketing & Corporate Communications, FirstBank, Folake Ani-Mumuney; Founder, The FactBox Company and Leadership-By-Data, Babajide Ogunsanwo and Executive Director, Investment Management and Oversight, FBNHoldings, Oyewale Ariyibi, at the FirstBank Nigeria Economic Outlook 2024 in Lagos

By Edu Abade

Economists, policy analysts and bankers have urged the Federal Government to explore ways to boost a robust and friendly business environment that would guarantee that Nigeria attracts and retains investors in the manufacturing sector with a view to reviving and sustaining the country’s economy.

This was the submission of stakeholders who brainstormed at the 2024 FirstBank Nigeria Economic Outlook, themed Current Realities and Prospects. The event, which was held in Lagos on Friday, January 12, 2024, had the financial institution restate its commitment to support its customers in agriculture and food chain, non-oil export, Micro, Small and Medium Enterprises (MSMEs), Fintech and other sectors of the economy.

In his welcome speech, Chief Executive Officer (CEO) of FirstBank, Dr. Adesola Adeduntan stressed the need for the government and private sector to urgently recalibrate to move the economy forward, stressing that since President Bola Ahmed Tinubu signed the 2024 Appropriation Bill into law early enough, and as such, failure is not an option.

“Allocating N9.99 trillion for capital expenditure in this year’s budget is a positive development. It will ensure that significant spending on infrastructure would create enough stimulus to tap into the government’s growth expenditure during the year.

“Also, an average of between 3.4 percent and 3.5 percent growth forecast for the year is significant and we are excited at the opportunities the economy offers. We are, therefore, committed to supporting our customers’ businesses in exploring the opportunities across all sectors,” he stated.

In his keynote presentation, Chief Executive Officer of Biodun Adedipe and Associates (BAA Consult), Dr. ‘Biodun Adedipe, said the Russia/Ukraine war, COVID-19 Pandemic, macroeconomic instability, social divisiveness, geopolitics, climate change and the Israeli/Hamas war constituted major disruptions to the economies of nations at the global level.

He explained that on the home front, fuel subsidy removal, unified exchange rates, lifting of the ban on 43 items from the official Foreign Exchange (FX) window, fiscal consolidation and Nigeria’s peculiar business environment were major domestic policy shifts that would affect the country’s economic outlook going forward.

Focusing on the 2024 economic outlook, he pointed out that Nigeria’s large, youthful and rapidly growing population as the sixth largest in the world and a median age of 17.2 years comfortably situates the country as the next most viable frontier for Foreign Direct Investments (FDIs) and economic boom.

Adedipe stressed that other interesting indices for positive economic outlook are rapid urbanization at 51.96 percent in 2020 and 53.96 percent in June 2023, up from 47.84 percent in 2015, deepening internet penetration at 45.57 percent in August 2023, rising from 31.48 percent in December 2018.

“There is also teledensity at 116.6 percent in December 2022 and 115.63 percent in August 2023, a drop from 123.48 percent in December 2018 (but 91 percent in March 2019) and global Internet users in which Nigeria ranks 11th worldwide.

“On exchange and interest rates, the Federal Government benchmarked the budget assumption at N800/$; significant utterance N650-N750/$, while JP Morgan pegged it at N850/$. The Monetary Policy Rate (MPR) of 18.75 percent is expected to be raised to reduce negative interest rate by closing the domestic inflationary gap of 26.72 percent and respond to rate differentials with dollar interest of 4.58 percent yield on 10-year treasury bonds and inflation of 3.7 percent,” he said.

He further explained that money supply and imports have maintained a relentless uptick on inflation rate, while local oil refining, revived manufacturing and focused export promotion will support stability to the Naira exchange rate, just as improvement in infrastructure would begin to positively impact the cost of doing business.

Speaking on what he described as the ‘sustained deep reforms’ of the President Tinubu’s administration, he said the government is focusing on global competitiveness and ease of doing business, plugging leakages and shrinking the space for economic rent, adding that Gross Domestic Product (GDP) projection for 2023 was between 2.45 percent and 2.72 percent, lower than 3.19 percent for 2022 and World Bank and International Monetary Fund’s (IMF) 2.9 percent forecast.

He noted that the Federal Government had projected an economic growth rate of 3.88 percent, compared to BAA’s 3.47 percent, World Bank’s 3.3 percent and IMF’s 3.1 percent, maintaining that while double digit inflation rate remains above 20 percent with likely average of 23.47 percent, stability of exchange rate of the Naira envisaged for First Quarter (Q1) of 2024 will be expected to average at the official rate of N900 to the dollar and PM average of N1,235 per dollar.

“Upward adjustment of MPR is likely in Q1’2024, which will start downward adjustment in Q2’2024 (or latest Q3 2024), banks lending rate will remain double digit and follow MPR adjustments, NPL in banks will likely increase in Q4’2023 and Q1’2024 while the economy will witness intensified digitization and rise of the digital economy,” he concluded.

Others speakers at the panel session moderated by Head, Strategy and Corporate Development at FirstBank, Chike Uzoma with Adedipe, Special Adviser (SA) to the President on PEBEC and Investment, Jumoke Oduwole, Founder, FactBox Company and Leadership-By-Data, Babajide Ogunsanwo and Executive Director, Corporate Banking Directorate of FirstBank, Oluwatosin Adewuyi as members, also stressed the need for collaboration between the government and private sector to achieve a robust and resilient economy.

They submitted that with Nigeria’s vast natural and human resources, a friendly business environment, synergy among appropriate government departments and agencies, as well as healthy collaboration with the private sector, Nigeria would remain the best frontier for investments and largest economy in Africa, just as FirstBank restated its commitment to providing support and guidance for existing and budding businesses in fiscal 2024 and beyond.