Investors, experts and practitioners brainstormed in Lagos on aviation financing calling for a better organised sector with resolutions suggesting international best practices, writes Elizabeth Toyon

Aviation financing in Nigeria faces several challenges that impact the growth and development of the sector. Some of the key issues include currency volatility, insurance challenges and multiple taxation.

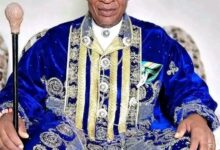

Key players in the industry including Dr.Gbenga Olowo, Chairman of Sabre, West Africa, Bismarck Rewane ,Managing Director of Financial Derivatives Company Ltd, Mrs. Olubunmi Kuku, Managing Director Federal Airports Authority of Nigeria (FAAN), Mr. Chris Aligbe, Chief Executive Officer of Belujane Konzult, Dr. Allen Onyema, Chairman of Air Peace engaged in discussions surrounding the issues at the 29th Annual LAAC Conference in Lagos, themed “Financing Aviation in Nigeria :Risks , Opportunities and Prospects ” to profer solutions to these problems .

Bismarck Rewane, the Managing Director of Financial Derivatives Company Ltd said as a result of deficient infrastructure and a fragmented system, Nigeria’s aviation sector lost $3.5 billion revenue between 2020 and 2022.

According to the Economist , the aviation industry has to be more efficient to be an attractive market to banks and financial institutions.

While delivering his keynote speech , he added that if the industry is efficient, better governance, transparency, accountability, and all other things will fall in place.

He further said out of Nigeria’s 32 airports, only 20 were fully operational in 2024, while 92% to 96% of traffic goes through just four airports.

He recommended that key players in the industry are united in order for the financial system to be viable.

“Nigeria has 23 active domestic airlines. The industry is ripe for consolidation but it’s fragmented. When you have a fragmented industry, people are consolidated, and they will shake out inevitably. Nigeria has poor management system and poor leadership.

“The industry itself has to be efficient in the first place to be attractive. Banks don’t throw away money, banks lend money to get it back. Delta Airlines, American Airlines, Lufthansa, Singapore Airlines are all doing well because they’ve become very efficient and innovative.

“Public-Private Partnerships should be prioritised for airport upgrades to aid national fiscal sustainability and avoid inefficient operations. There should be investment in local maintenance, repair and overhaul hubs.

“Government should focus on policy and regulation, not running airlines or building airports directly .Policy consistency is crucial for rebuilding trust with global investors and attracting global aviation capital.” he said.

Mary Olowo-Sokeye , the Group Chief Financing Officer of InterGuide Group of Companies , Inclusive of Sabre Travel Network, who represented Chairman of Sabre, West Africa, Dr. Gabriel Olowo explained that Nigeria’s operational success rate stands at just 48%, far below the international benchmark of 81% as aircraft is not cheap and there is no maintenance, nor the innovation needed to run them.

She said the the gap is not due to a lack of talent or passengers but it’s a financing problem.

Olowo-Sokeye explained that with aircraft loans, benefits like tax deductions, flexible payment structures, and depreciation can be enjoyed, but strong liquidity and a healthy cash flow to manage repayment must be acquired.

“To fund aviation sustainably, we must review our financial health, understand market conditions, and explore creative funding mechanisms.

“A sale-leaseback unlocks liquidity, allows flexible financial planning, and offloads asset management burdens. However, lease payments can be steep, and you lose long-term asset value.”, she said.

The Chairman of LAAC , Mr. Suleiman Idris , while giving his remarks said to unlock the potentials in the aviation industry ,innovative financing mechanisms, ranging from public-private partnerships, building, operating, and transferring models, leasing arrangements, to sovereign-backed financing and targeted foreign direct investment must be embraced.

He pointed these tools cannot thrive without a manoeuvrable environment, one that assures policy consistency, regulatory transparency, and ease of business.

According to him, the aviation sector is capital-intensive by nature, requiring substantial investments in airport infrastructure, aircraft acquisition, maintenance, safety systems, and personnel development.

The LAAC Chairman noted that Nigeria, like many developing nations, faces challenges such as limited access to long-term financing, high interest rates, foreign collectivity, policy inconsistency, and a lack of universal confidence, all of which appear to be real and pressing risks.

He called for collaboration among the government, private sector players, financial institutions, and the media.

“Nigeria’s large population, our strategic geographical location, a growing middle class, and an increasing appetite for domestic and international air travel present a compelling case for targeted aviation investments.

“The Nigerian aviation industry must also commit to building investors’ confidence through sound governance, accountability, and a clear vision for the future.”, he said.

The Chairman of Airpeace Ltd, Dr. Allen Onyema stated that Nigerian Airlines are being overtaxed by regulatory agencies and this affects the aviation financing systems negatively.

He opined that payment of tax is necessary but it should amount to cost recovery for airlines operations to be sustainable.

While speaking during the panel session ,he revealed that Airpeace faces several difficulties which involves infrastructure, multiple charges and dearth of foreign exchange, among others. He noted that these difficulties have restricted the advancement of indigenous airlines.

Onyema said the airline is yet to go public because it is focusing on building a strong foundation first.According to him, when a company goes public, it offers shares to the public through a country’s stock exchange, like the Nigeria Exchange Group (NGX) and it allows organisations to raise funds without going to the banks, but also increases regulatory scrutiny and oversight.

He added that the choice to remain private is driven by the desire to build a lasting legacy and protect the interests of staff and stakeholders

He asserted that one of the reasons for delaying listing on the capital market is to avoid external pressure from minority shareholders who could disrupt the company’s philanthropic and people-oriented operations.

“The 5% we pay for the ticket fares to Nigeria Civil Aviation Authority (NCAA) is affecting airlines.It is limiting our ability to charge for the tickets.The other way around, they’re collecting from the passengers directly so that whatever we collect from the passengers will belong to us. I have not said that we should not pay anything to companies, but it has to be cost recovery. All over the world, even what the accountants do is about cost recovery.

“The government needs to come to the aid of the airlines by creating a special window for them where they can easily access foreign exchange at a cheaper rate. On our own too, the airlines should have financial discipline, while the government can also come in through the central Bank of Nigeria (CBN) and the African Development Bank (AfDB) and other means to assist the airlines to remain in business.

“We want to build a legacy that will stand the test of time. Some people have told me I can get up to $100 billion with all the aircraft I have ordered.”

“If it is about money, I would have done that (listed) a long time ago. I would have gone to the public, maybe made money as some people advised me, and walk away. It is not about that.I am thinking about over 4,000 people who are working with Air Peace today.

“I am thinking of the people who would take us to court every day after investing just 0.5 percent. They may not allow us to continue some of the philanthropic things we do.”

While speaking about the prospects and opportunities of financing aviation in Nigeria, Ayodele Olatiregun , the Director of Finance and Accounts at Federal Airports Authority of Nigeria (FAAN) who represented the Managing Director , Mrs. Olubunmi Kuku , said because the aviation sector is a long-term sector, it requires long-term investment as it concerns the acquisition of standard infrastructure.

He noted that there are opportunities with development finance banks and institutions and that the government is already putting things in place around finance, of which an example is the creation of more opportunities for airlines to acquire aircraft through dry lease arrangements by the Minister of Aviation and Aerospace Development, Festus Keyamo .

“If the right infrastructure is in place, it’s easier for everyone to operate.There are sale and lease-back opportunities and pre-delivery financing schemes. There are so many schemes.

“In fact, now there are developments around import and export banks that are working on export and credit. There’s also financial engineering around asset-backed securities and setting up Solicitors Qualifying Examination (SQEs) for poeople that have deep knowledge and deep understanding of the industry.”

Mr. Chris Aligbe , Chief Executive Officer of Belujane Konzult who also spoke during the session emphasised that the aviation industry is a sub-sector which closely links with each other. He explained that if the airlines are not doing well, the airport is not going to do well and this applies to the companies involved.

He reiterated that without formidable airlines, Nigeria will never get a hub where airlines can concentrate their operations and connect passengers from various origins to their final destinations.

Aligbe kicked against the idea of Nigeria having an aviation bank.According to him, Nigerian Airlines might not be capable of funding or supporting an aviation bank.He advised that a special window is created in order for airlines to access forex.

“I do not believe those who say let us have an aviation bank. There have not been enough to support an aviation bank. There should be a special window for modernizing on forex so that airlines that have money will go there, access forex, and be able to repair their aircraft and carry out other financial related issues.

“For me, the airlines should be the breaking point. We might be modernizing our airports but if flights are not going there, the airports will deteriorate and that is what is happening in our country. I think that if we don’t build up our airlines, we will not get to where we are going to be. No airport in this country will become a hub if we keep depending on a foreign airline.

“I believe that our country is ripe enough to have three formidable airlines. Not less than three formidable airlines that can serve the country.”, he said.

hiinn8