Banking Sector Has Capacity To Drive Sustainable Growth, Financial Inclusiveness, CIBN Declares

The Chartered Institute of Bankers of Nigeria (CIBN) has declared that the banking sector in the country is uniquely positioned to drive sustainable growth, foster innovation and ensure inclusivity in every segment of society.

President and Chairman of Council, CIBN, Prof. Pius Olanrewaju stated this at the 2024 Lagos Bankers’ Night with the theme: Driving National Growth Agenda: The Role of the Banking Sector, noting that bankers play vital role in elevating standards of the profession and advancing the broader goals of national development.

Olanrewaju, who is the 23rd President and Chairman of CIBN Council, said the annual Lagos Bankers’ Night is a cherished tradition that offers members a moment to reflect on the collective journey and opportunity to set the stage for future triumphs in the banking industry.

He said the theme was significant, as it serves as a powerful reminder of the role of banks in shaping the economic destiny of the nation, adding: “As the backbone of the economy, the banking sector is uniquely positioned to drive sustainable growth, foster innovation and ensure inclusivity.”

Highlighting the place of the banks, he cited the National Bureau of Statistics (NBS) report that Nigeria’s financial services sector contributed significantly to GDP annual growth rate of 2.98 percent in the first quarter and 3.19 percent in the second quarter of 2024

Olanrewaju viewed that the role of banks goes beyond traditional financial intermediation, adding: “We are the engines that power the wheels of commerce, the architects of financial innovation and the custodians of national wealth.”

He noted that the Central Bank of Nigeria (CBN) report that Banks loans and support for the private sector rose to about N375 7th in the first five months of 2024, which is about 74 98 percent higher than N214 76th recorded in the same period of the previous year, indicates that the banking sector has continued to provide increasing support for the economy.

The CIBN boss noted that the sector has a unique mandate to unlock the potential of our vast human and natural resources, to fuel entrepreneurship, and to ensure that financial opportunities reach every comer of the diverse society.

“We must harness the power of technology and remain steadfast in our commitment to ethical practices. The strategic direction of our industry must align with the broader goals of national development-creating jobs, supporting small and medium enterprises, driving industrialization, and enhancing the quality of life for all Nigerians.

“It is through our collective efforts that we can transform challenges into opportunities and turn aspirations into realities. Our sector’s influence is vast and with that influence comes the responsibility to act as catalysts for change and progress.”

He noted that bankers were not just participants in the economy, adding: “We are its architects. By leveraging our collective expertise, we can chart a course that leads to enduring prosperity for our country. When we perform our expected roles, the banking sector will contribute significantly to Nigeria’s economic growth that has already been projected by the IMF to be around 3 percent by the end of 2024.”

Looking at the challenges confronting the economy like high inflation rate, infrastructural deficit among others, Olarewaju canvassed public private partnership relationship in this respect.

“We need everyone to collaborate as only the government cannot solve the problems on ground. There is no doubting the fact that today we have some economic challenges, but the government alone cannot do it. There is a need for a public-private partnership relationship in this respect.

“We are saying, every one of us, even including you journalists, you have a role to play. It’s not about banking alone. We need support and encouragement from all stakeholders to achieve the growth agenda.”

Chairman, Lagos State chapter of CIBN, Adeyemo Adeoye, said the event has become a perennial platform for networking among bankers in (and outside Lagos State, financial industry leaders, key stakeholders in the Nigerian economy, captains of industries and it has equally provided prime opportunity for exchange-of-ideas, while providing leverage for Corporate brand visibility and exposures.

He applauded the theme of the event, noting that the banking industry has traditionally played a significant role in Nigeria’s economic development.

“Because of the financial aggregation and intermediation functions of the banking systems, its roles are inextricably intertwined with the growth of the economy,” he said.

Quoting Richard Branson, Adeoye pointed out that banking remains the life blood of the economy, providing the financial oxygen businesses and individuals need to breathe and grow, noting: “Our banking industry will play significant roles in policy and growth direction of the economy and, this is inexorable.”

Director-General of the Economic Think-Tank Centre, Prof. Emmanuel Moore Abolo also stressed the need for collaboration to achieve the growth agenda.

He said: “All the stakeholders in Nigeria need to come together to drive the national growth agenda by pulling all the forces together to one single direction called the vision training access and then everybody is able to contribute.”

He stressed that the CBN needs to align the monetary policies with the fiscal, which is key, create institutions, play its roles of intermediation and ensure that resources are made available for implementation of all the strategic initiatives contained in the agenda.

“Here we try to bring in the banking sector. What can banks do to drive this growth? Our submission is that banks play the role of intimidation.”

He also pointed out the need to create awareness among Nigerians to galvanise support to achieve the growth, adding: “More fundamentally, we are talking about crafting a robust implementation. It’s one thing to have a plan and strategy, and it’s another thing to implement the strategy.

“So we are saying we need to awaken the soul of Nigerians, bring everybody on board and see how to push this agenda forward to support the government to be able to implement the agenda, if not 100 percent at least 80 percent of the plan.”

He maintained that creating awareness for Nigerians is an important factor “as about 80 percent of Nigerians are not aware that we have an agenda, the awareness is important to get the needed support. So, all can work together to drive the implementation of the growth agenda.”

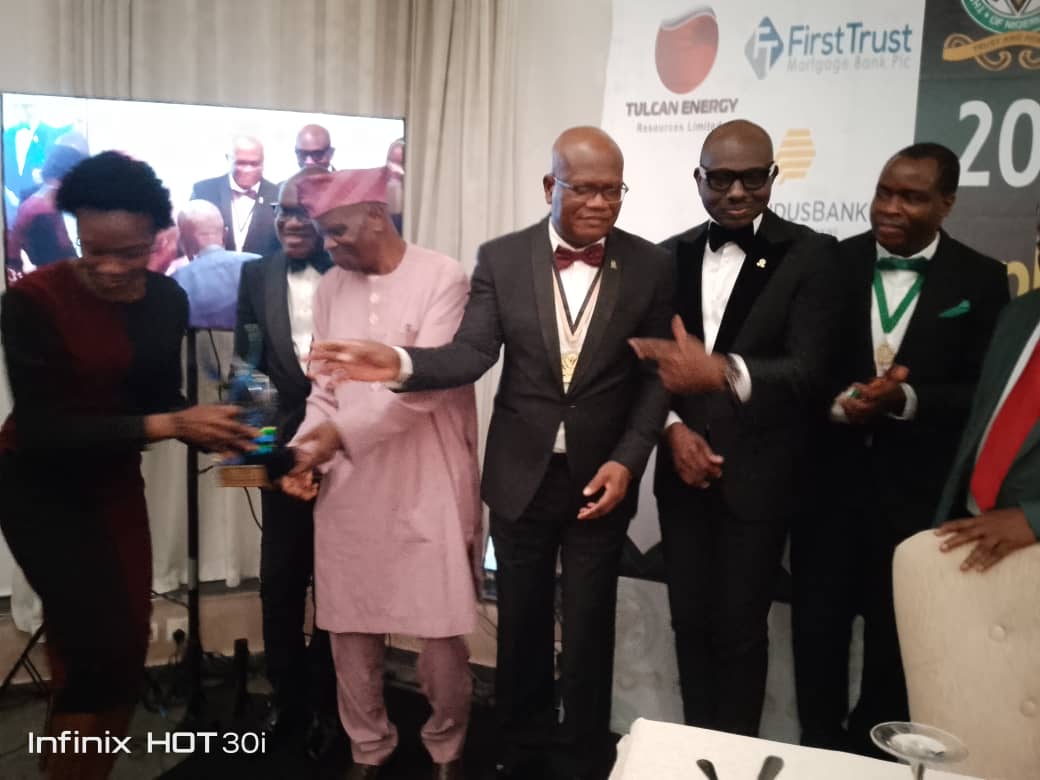

The high point of the event was presentation of awards to valued partners and contributors.